Low-Fi: Quantitative Easing 101

Today, I'm focusing on a non-technical article (Low-Fi series) to explain how Quantitative Easing works in a simple and easy to understand way. This is a bit selfish of me, as I have had to explain this to a lot of friends over the past few weeks, so I thought I'd just write a blog post.

What is Quantitative Easing?

Quantitative Easing has a very simple definition:

"...is a form of unconventional monetary policy in which a central bank purchases longer-term securities from the open market in order to increase the money supply and encourage lending and investment."

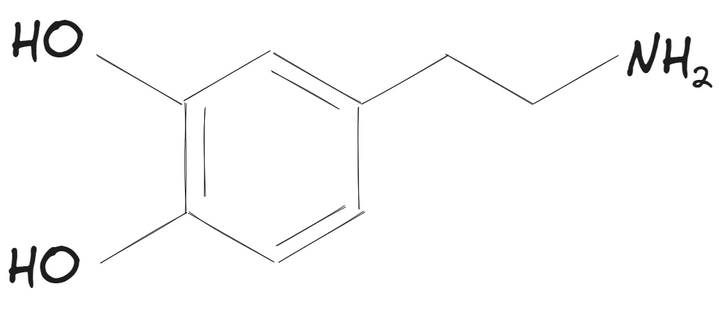

However, that is an explanation of what happens, but what is the effect this action has on an economy? Imagine that there are three groups of people and they all have equal amounts of Currency. They can purchase things freely and, each person's money is worth the same amount. Let's refer to this as Purchasing Power (PP).

Generating the Cash

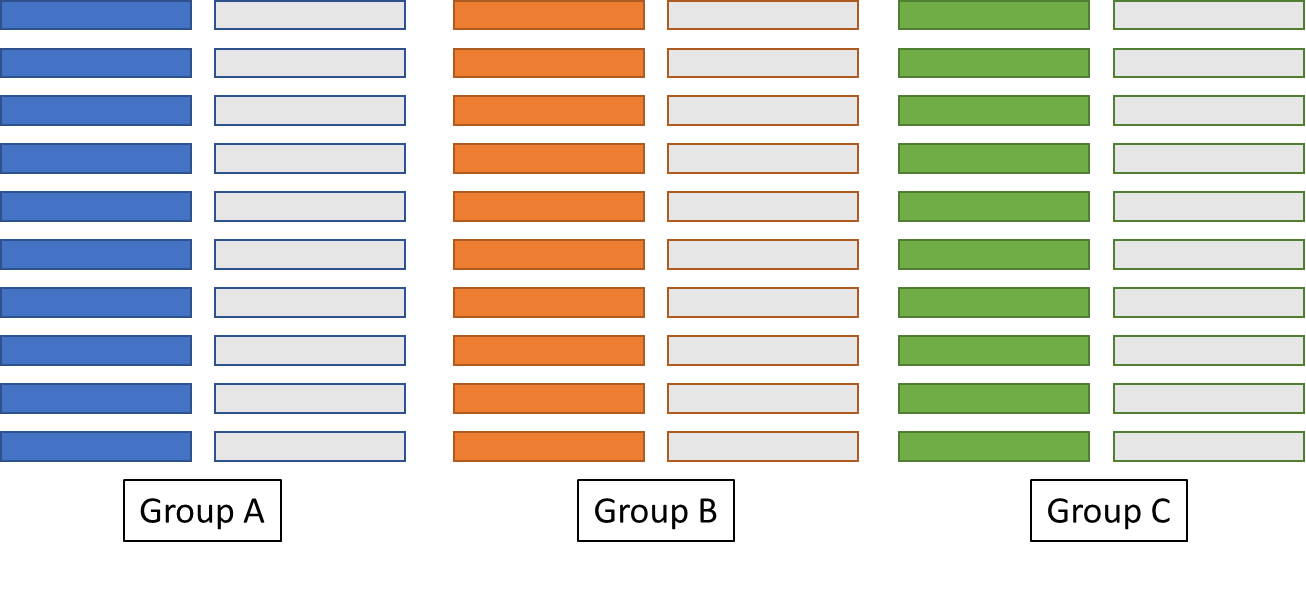

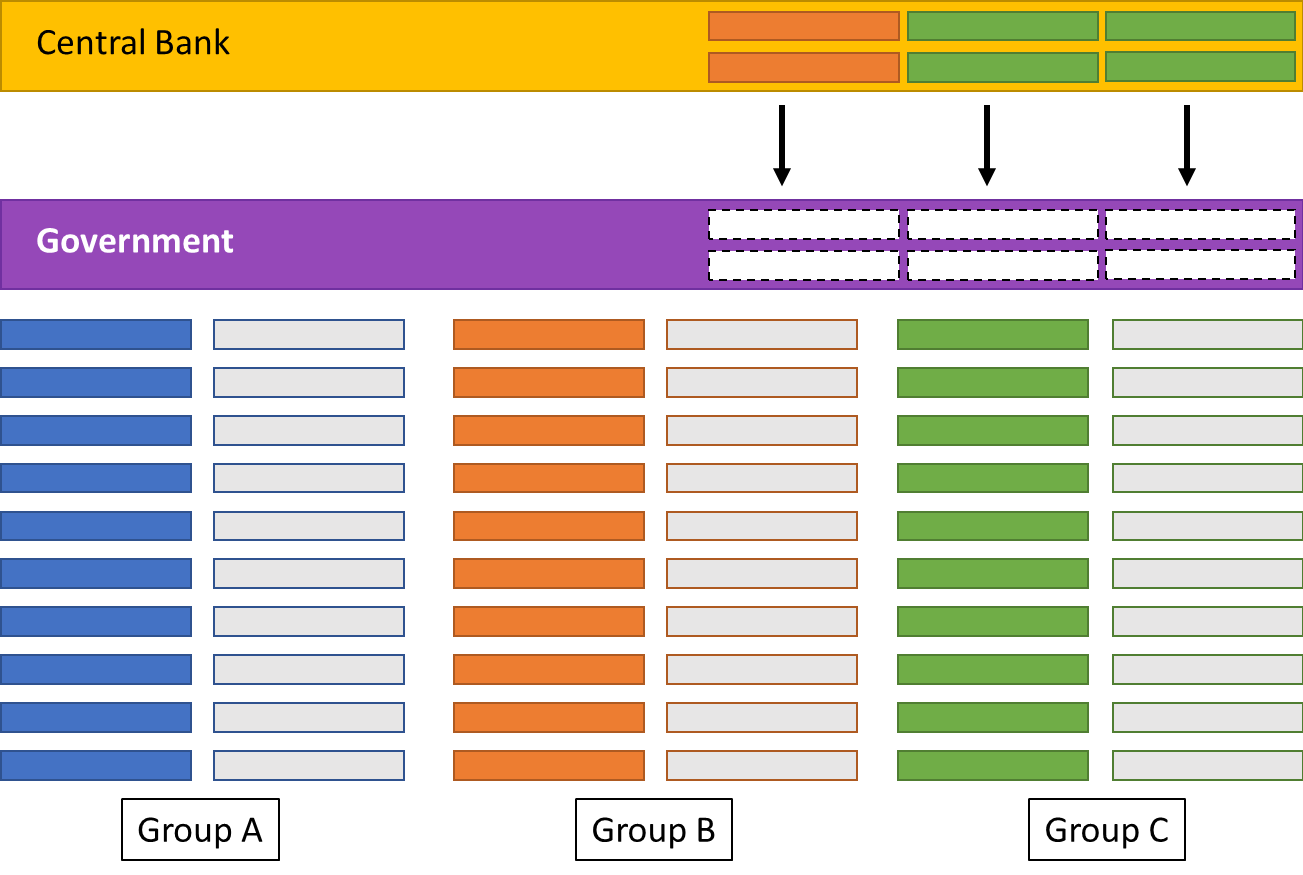

Seems pretty straight forward, right? Generally this is what each income group looks like in an economy where QE is not in effective. Everyone else's dollar is as good as each other. However, let's introduce a second factor: the Central Bank. The Central Bank sees that B and C are struggling, and need extra PP. So, they generate 6 units of currency: 2 for B and 4 for C. The problem is that the Central Bank is not responsible for giving money to people: it can only buy other people's stuff.

Making the Drop

Enter the Government. The Government can distribute money to people through tax breaks, direct payments, or the introduction of projects. To facilitate the transfer of currency, the Government issues a set of bonds for the amount of money it needs to distribute into the economy to support B and C. The Central Bank buys them, holding the bonds as assets with very lenient repayment schedules, no interest (or perhaps negative interest), and transfer the currency to the Government.

Distributing the Cash

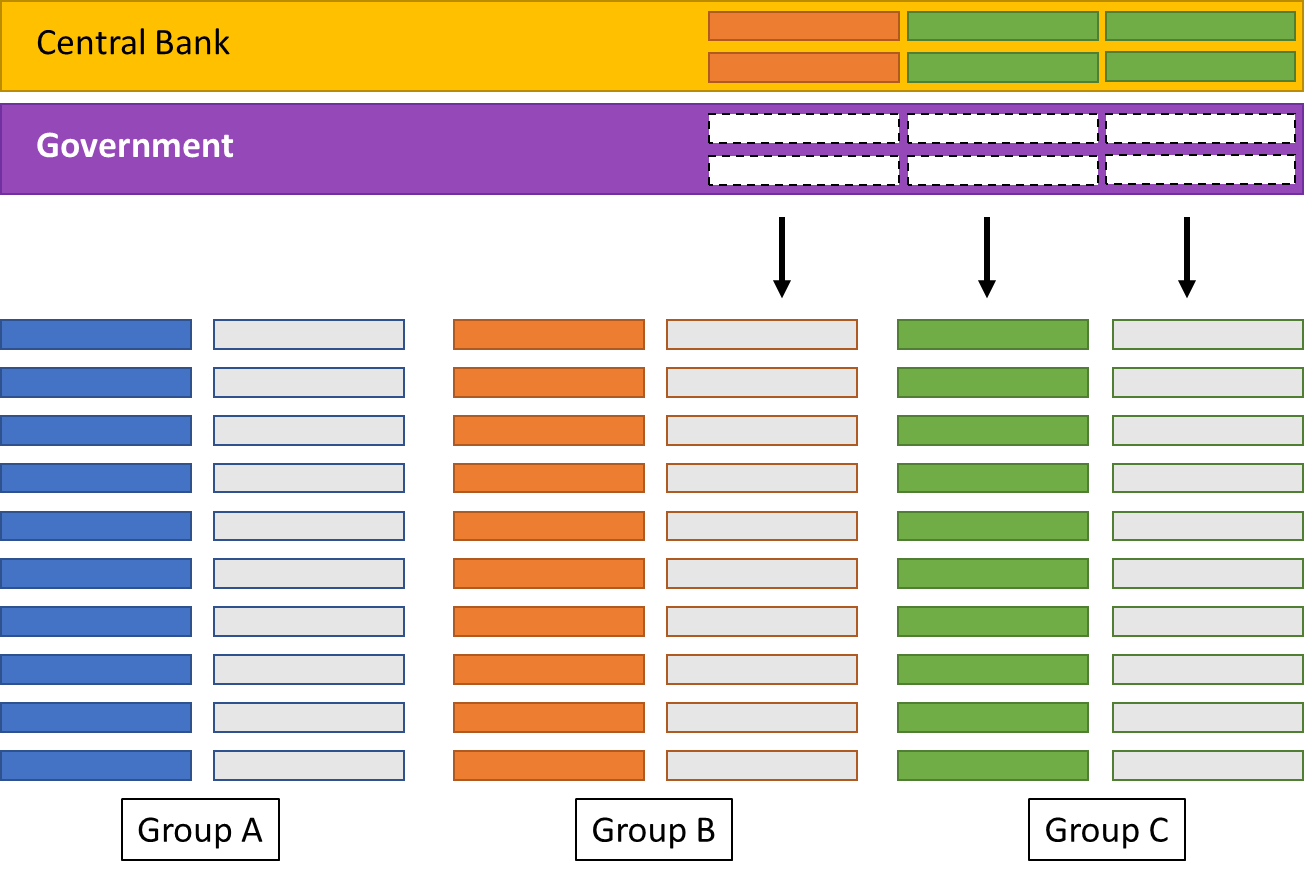

Now the Government, has the money, it can distribute it to the groups that need it. In our example, we will assume this is a direct cash payment to make it simple to understand. Groups B and C receive, money and Group A receives nothing because they are weathering the storm effectively.

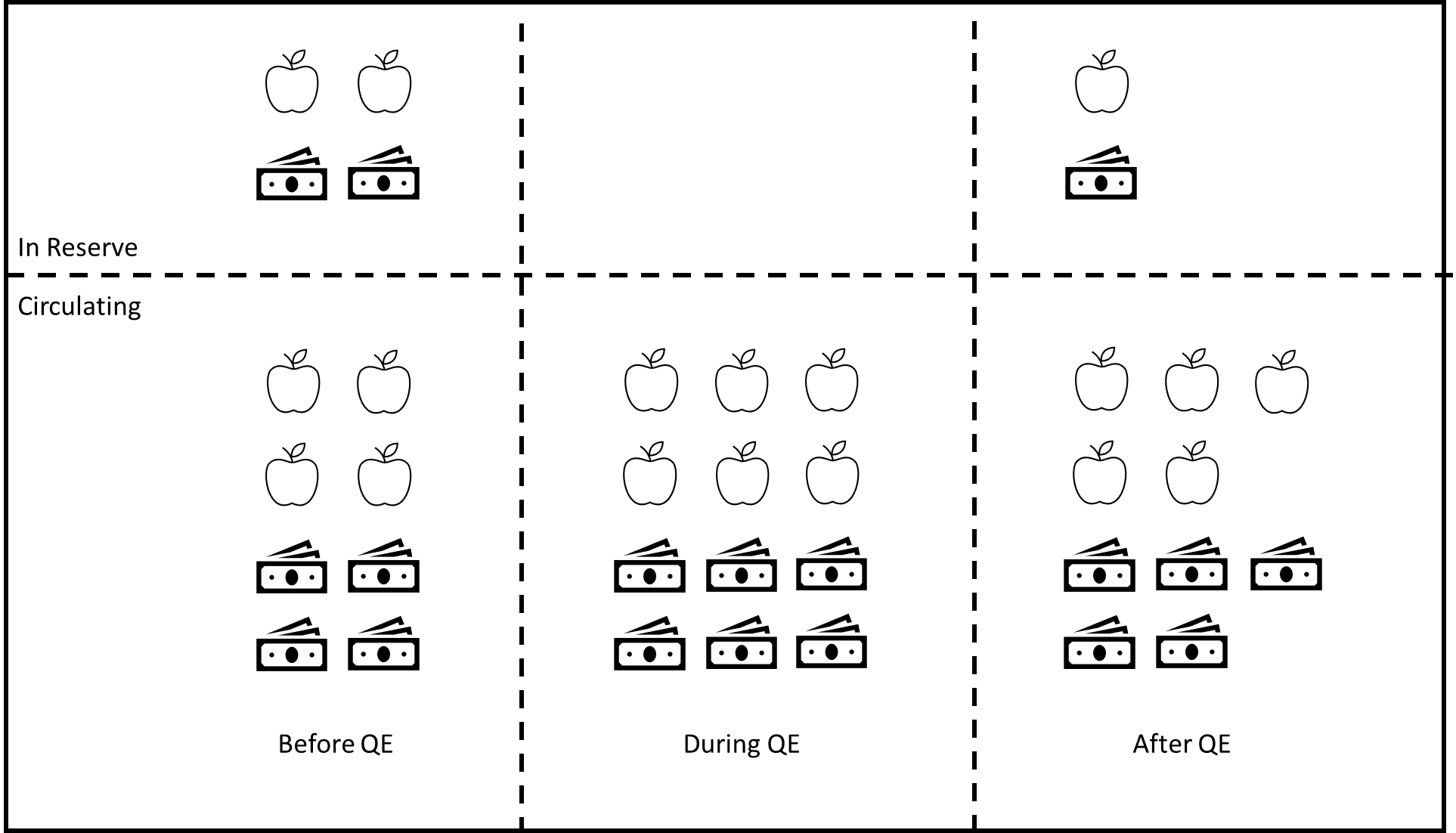

Now most people assume that what happens is something similar to the following: each group receives more money, and they can just use that money to buy more stuff.

However, it's not that simple because (in this example) there is 30 total units of resources, represented as each Group's PP. By introducing extra cash, there is simply more currency to trade but the exact same amount of resource still exist in the economy. It may have some long term effects which result in more resources (discussed later), but immediately there are no extra resources.

Redistributing the Wealth

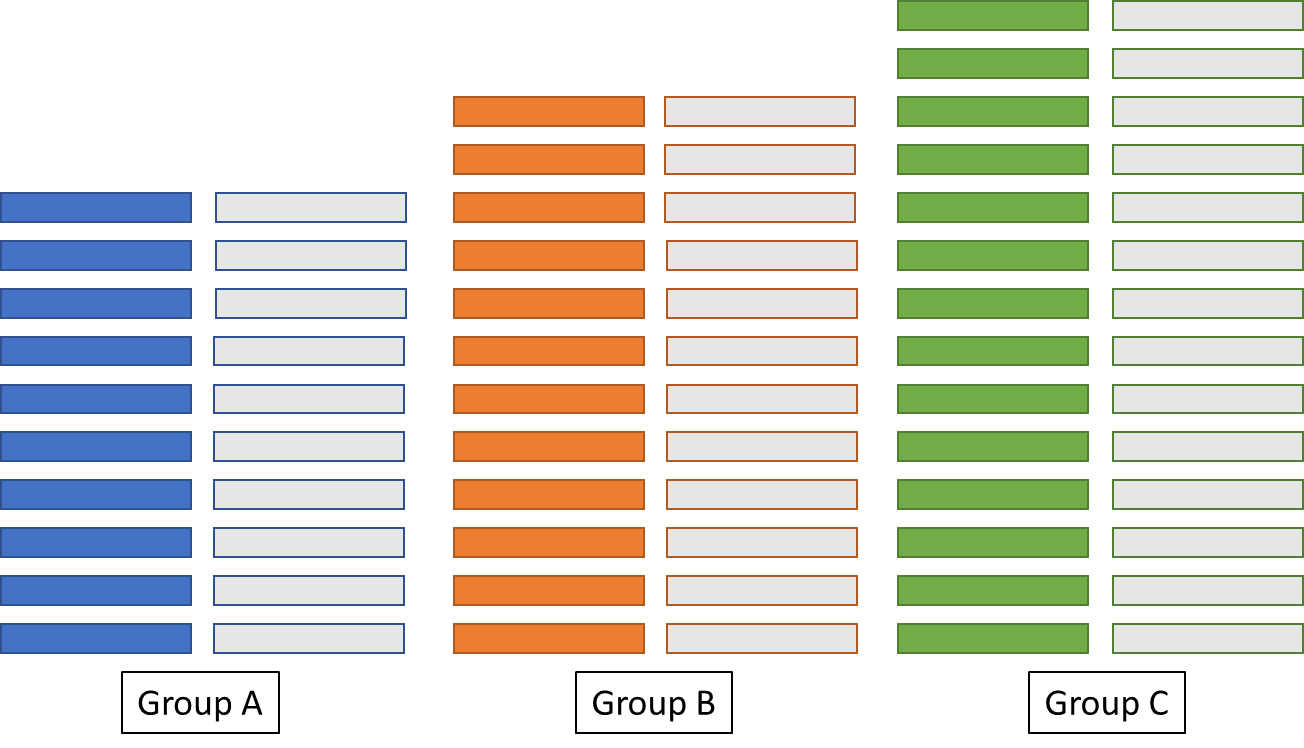

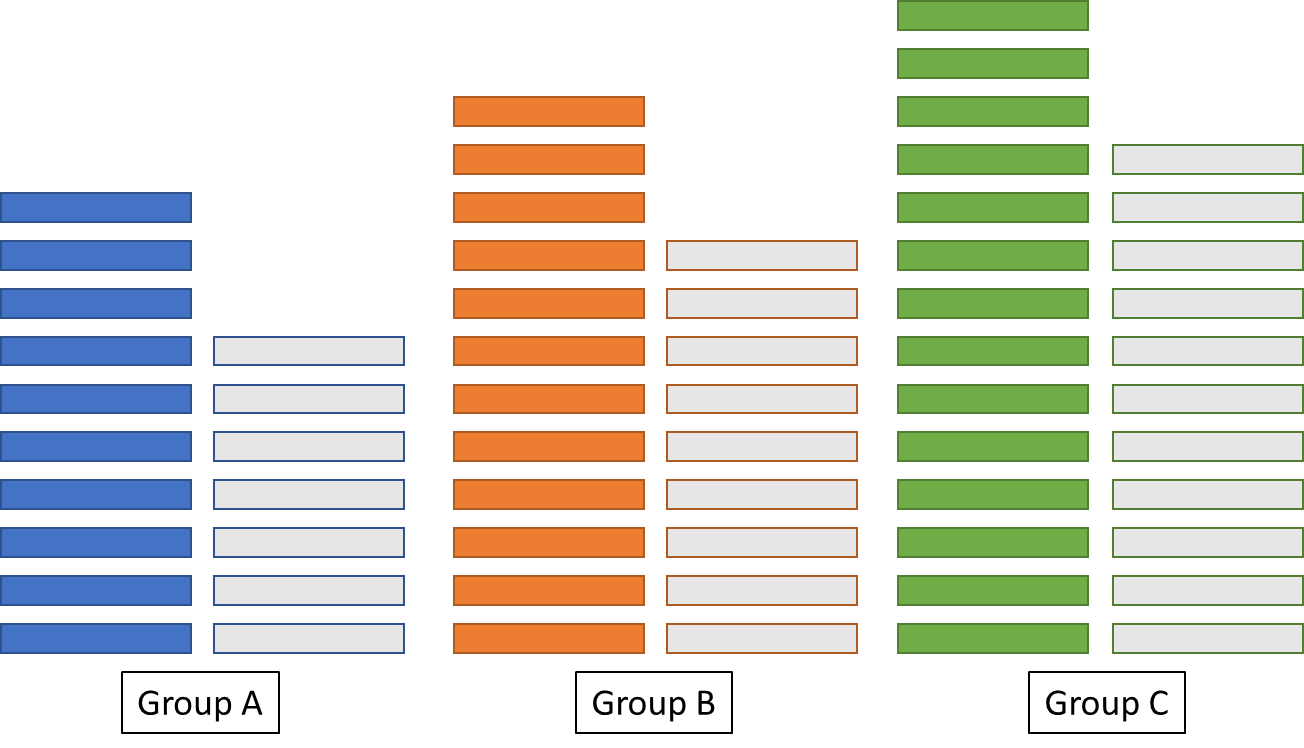

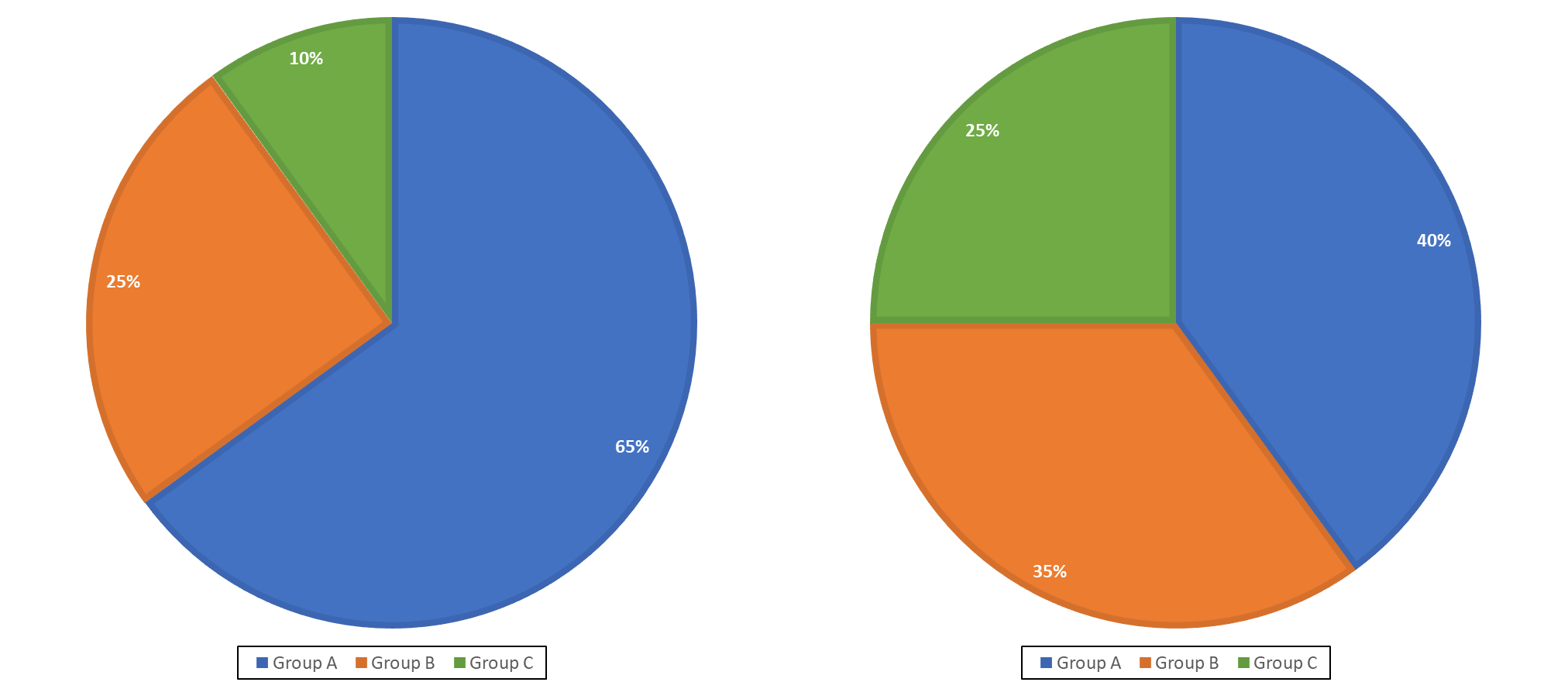

What actually happens in practice, is that wealth is redistributed throughout the economy. Each group that is given extra cash, has a higher percentage of currency, and the not-at-risk groups have less currency. What has happened, is that C has had it's PP raised, B has had it's PP slightly lowered while the latter group has had their purchasing power decreased substantially. B has still lost out, but not as much as A.

It is important to note, that Groups A and B may have their PP decreased, but they generally have more Wealth. They are forced to dig into their reserves where the other groups may have none. So while the week-to-week changes are very significant, the overall wealth ratio should only be slightly affected.

As you can see in Figure 7, at the beginning of QE there was a severe wealth skew towards Group A. After QE, the wealth is more evenly distributed. This means that each group has relatively equal access to resources and capital.

What are the Effects?

The whole point of QE is to basically spread economic pain amongst the entire economy. This reduces the chance that at-risk groups will be severely negatively affected. In the long term, the effect deflates the current value of currency and inflates the value of goods and resources. Generally in these scenarios, immediately people will have access to more resources, and stocks will be depleted. This spike of demand results in more economic activity. However, as producers (who generally have wealth) see their own wealth decrease, they will raise their prices. This in turn reduces the amount of resources in circulation (as people will stop buying so many), and has the effect of normalising the PP of each group.

The aim of this is to stimulate the economy by getting more stock and money into circulation. This in turn requires more people working to produce stock, and this increases economic activity. QE is meant to be a jump start to the economy that basically brings it back from life support, and starts it running again. QE is meant to be a temporary measure to stimulate long-term economic growth.

Is it Effective?

Now that we have a good understanding of what QE is, the real question becomes "How effective is QE at stimulating economic growth and protecting people from poverty?" QE has been shown to be somewhat effective, however, in practice the Government almost never pays off the debt. It is a fine line between stimulating the economy to protect the future, and burdening future generations with so much debt they will be unable to survive. The US Federal Reserve has had ever increasing balance sheets to satiate the US Federal Government's desire for cash. It is possible that this will eventually cause a lot of economic strain on future generations when the bill comes due.

The long-term problem with Governments using inflation to pay their debts is that it reduces the overall value of currency, which means they have no immediate bills to worry about. But this means that in the future, investors will be less likely to invest in a country at all because they know they will never make a profit on their investments if their dollar today is only worth fifty cents tomorrow. In a globalised economy, this becomes a severe problem as it impairs trade and limits the ability of a local economy to source resources and materials not made in-country.

Only time will tell if Governments dipping their toes into QE to address the current crisis will handle the long-term economy management of their country or whether they will become addicted to the flow of easy money.